Did you know that an estimated $4 – $7 billion in matching gift funds goes unclaimed per year?

The matching gift process involves submitting a donation with the knowledge that someone else–whether an employer, a company, or another individual–will match your donation at a predetermined ratio. Often, this results in double the money for the lucky recipient.

However, to receive the matched gifts, it’s usually required that a matching gift form is submitted by the donor. Without this form, this matching gift opportunity is lost. Many eligible donors don’t even know they qualify or that the matching gift form exists!

We’ve written on the topic of matching gift best practices before. As a top provider of nonprofit fundraising software, Qgiv knows a thing or two about how to leverage this type of opportunity and increase your organization’s revenue. This guide will cover the following topics:

- What are matching gifts?

- Types of matching gift forms

- What is a matching gift database?

- How to use matching gifts with Qgiv online donation forms

Ready to begin? Let’s start.

What are matching gifts?

Let’s start with the basics. As you already know, matching gifts are the act of another entity matching a donation at a 1:1 (this could be lower or higher) ratio. This ratio is usually predetermined, along with the types of charitable organizations that are eligible for a matched gift. This information depends on the type of matching gift program you participate in.

Sources of matching gifts

If you find yourself eligible for a matching gift, it will usually come in the following three forms:

- Corporate matching gifts. Corporate matching gift programs involve an employer matching the donations of their employees. This will be at a set ratio and have a predetermined list of eligible charitable organizations. Many people don’t even realize that their employers have this program set up and thus miss out on making a greater impact. This type of program requires the completion of matching gift forms to confirm the employer’s participation.

- Personal matching gifts. This is similar to a corporate matching gift program except the person matching the gift isn’t your employer. This will likely be a generous supporter to the organization who vows to match eligible gifts up to a certain amount to a specific organization (If you’ve ever listened to NPR’s fundraising drives, you’re definitely familiar with “a generous donor offering a match for a limited time!” We hope you read that in your best radio announcer’s voice.). This might also require a matching gift form.

- Matching gift campaigns. This is a larger and more focused matching gift effort made by the recipient charity. Your organization might recruit a business, benefactor, board member, or foundation to match gifts made up to a certain dollar amount. Then, you’ll reach out to donors about the match opportunity and encourage them to give. You’ll have to report the money received to the matching provider, and they’ll match the gifts up to the promised amount. Finding the right match sponsor might have to be done through personal asks or via a formal grant application.

Now that you know the different opportunities you have for matching gifts, let’s dive a little deeper into how the actual process works.

How do matching gifts work?

Matching gifts are wonderful opportunities that result in more donations to your organization without breaking the backs of your loyal supporters. Nonprofits, educational institutions, hospitals, and even political organizations can make use of them. However, there are a couple of elements and nuances you should be familiar with before you start actively advertising your matching gifts program. These are:

- Donor eligibility. This is simply to confirm if the person making the gift can have their donation matched. Whether the employer will match the gift or they’re giving to an official matching gift campaign are factors to consider for eligibility.

- Charitable organization eligibility. Even if the donor is eligible, it doesn’t mean the organization is. For the gift to be matched, the recipient charitable organization must fit requirements (like type of organization or size) or be on a predetermined list.

- Maximum and minimum gift amounts. Sometimes, only a certain gift amount or range will be matched. For instance, in a corporate matching gift program, an employer may only match a gift if it’s between $100 and $500. If the gift doesn’t fall within that range, then the gift isn’t eligible.

In order for the matching gift to go through, the above requirements must be met. This can usually be reviewed with the matching gift forms the donor must fill out and submit along with their donation.

Types of matching gift forms

Matching gift forms are needed to assess the donation and donor, as well as the recipient organization. The forms are submitted to the matching gift partner via either a paper form or an electronic form.

Paper matching gift forms

Paper matching gift forms are the original vehicle for this type of information. Even if most of your donors will likely rely on the electronic form, not offering a paper version could turn away a few of your more traditional supporters.

Your paper matching gift form should have the following elements:

- Employee identification numbers.

- Personal information such as a mailing address and phone number.

- Donation amount.

- The recipient organization’s name.

- The type of organization (e.g. cultural, educational).

- Donation date.

Each matching gift program and provider will likely have their own matching gift form, so it’s crucial that you find the right one, print it, and fill it out. Then, submit it (likely by mail or fax).

Electronic matching gift forms

With our increased reliance on technology and modern solutions, electronic matching gift forms are now the popular and convenient way to confirm eligibility.

An electronic matching gift form will usually involve the following steps:

- Donors access the electronic matching gift form online. This might be on a company’s website, but you should look at the matching gift program details to find out the specifics.

- Donors find the nonprofit organization on a list of IRS 501(c)(3) organizations.

- Donors submit information about their gift such as the amount and the date.

- The electronic matching gift request is sent.

When a match request arrives, the matching gift partner reviews it and deems it eligible or ineligible. At this point, the recipient organization is notified that a matching gift request has been made. The nonprofit must confirm receipt of the original gift to approve the request. Nonprofits might also have to verify that they indeed have 501(c)(3) status.

When the gift is verified, the matching gift partner will submit their own donation.

Electronic vs. paper matching gift forms

The majority of your matching gift donations will be submitted via an electronic form.

With electronic forms, the matching confirmation process is much more streamlined and efficient because donors complete the forms online (Let’s be honest… we’re probably all more likely to fill out a digital form than we are to print, manually fill, and submit a paper form!).

Electronic matching gift forms also give your donors more freedom when it comes to submitting their requests. And when forms come in, that data can go directly into your fundraising database.

The use of electronic forms also coincides with matching gift databases, a key tool that nonprofit leaders use to encourage matched gifts and automate this entire process. However, paper forms are still a good back up option for those companies that require them.

What is a matching gift database?

A matching gift database is a tool that holds a collection of information on matching gift programs and their specific details. This includes thousands of companies and their employee giving, as well as other corporate philanthropy programs.

Benefits of a matching gift database

Though not necessary, without a matching gift database, it can be difficult to advertise and push matches to completion.

A comprehensive database even empowers your donors to search on their own to determine if they’re eligible for matching gifts. For instance, they can look up their employer, and if there’s a program available, get access to all the pertinent details.

Your best bet? Partnering with a matching gift database company. Here are some of the specific benefits:

- Access to more employers and their resources – Depending on the company you partner with, there will be a vast number of matching gift programs your donor can quickly look up.

- Automation capabilities – Some matching gift database companies can even step in and automate the process altogether. This means that the tool can scan for eligibility for your recent donors. If there are eligible matching gift opportunities, the company will automate an email letting them know. It can even track what stage the donor is in during the submission process and send subsequent email reminders to complete the matching gift form.

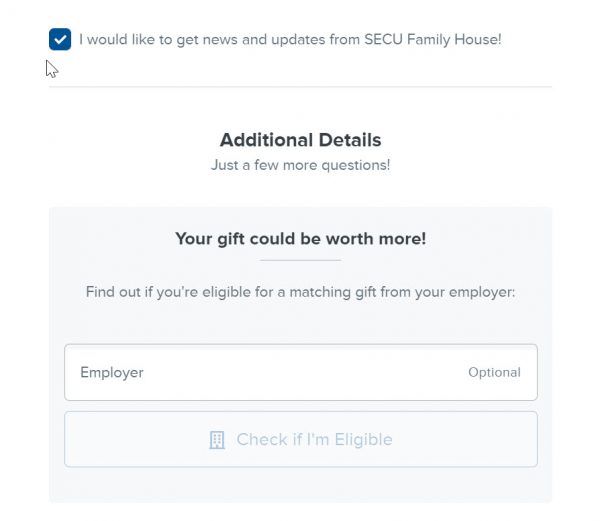

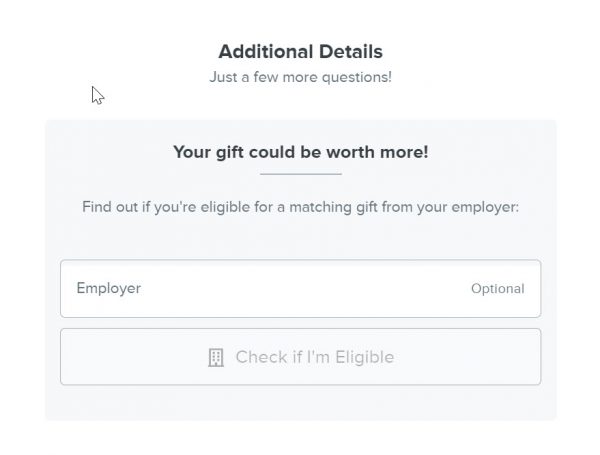

- Seamless part of your giving experience – You can even embed a searchable matching gift database within your online donation page. This way, as soon as a person makes a gift, they can quickly look up if they are matching gift eligible. For instance, they can search for their employer’s name and then receive the specific requirements and details of the program.

There are multiple matching gift database companies that you can reach out to. Read on to explore the top ones in the industry.

How to choose a matching gift database company

Every matching gift database has its strengths and weaknesses. It’s best to look at them with the following criteria in mind:

- History – How long has this company been active?

- Comprehensiveness – How comprehensive is their database? Do they include other corporate philanthropy data?

- Matching gift forms – How many matching gift forms are readily available?

- Accuracy – How accurate and up-to-date is the database?

- Search functionality – Does the database account for typos or other common mistakes?

- Ease of use – Is the database intuitive for even your less tech savvy supporters?

- Integrations – Can the database integrate with your existing nonprofit software?

Top matching gift database companies

With these qualifications in mind, let’s review some of the top providers in the game currently:

- Double the Donation is an industry-leading matching gift database designed with supporters in mind. Though it might not have been around the longest, it has a rich resource of companies and their matching gift forms are readily available. Fundraisers can even embed a searchable database within their donation page so that donors can quickly search for their employer. And, they likely integrate with your favorite nonprofit software.

- HEPdata is the oldest player in the game. They were the first electronic matching gift database in the US. HEPdata can make the matching gift process much easier by offering searches right within the donation form. With its eMatch Donor Link, donors can search for their employer before, during, or after a gift and receive all the necessary information. They also have a wide integration network.

- CyberGrants is a software solution for grants management, corporate philanthropy, employee giving, and foundations. With it, corporate leaders can connect their employees to each other and to their charitable partners to encourage employee giving, especially within their matching gift programs.

- Amply is a matching gift automation provider. They’re a pretty small provider, but they do offer a widget that nonprofits can easily add to their donation page. This has helped many of its clients reduce their matching gift cycle time.

- MatchFinder isn’t a specific company, but a feature offered with Raiser’s Edge and Blackbaud CRM. Blackbaud is an extremely popular CRM, so if you use it you likely already have access to this capability. This is their own matching gift database that their clients and their clients’ supporters can use to determine their eligibility.

In terms of integrations, Qgiv is compatible with Double the Donation, HEPdata, and CyberGrants. This means that data can freely flow from your fundraising database to your matching gift tools and vice versa. Read on to explore further how you can use Qgiv to increase matching gift donations.

How to use matching gifts with Qgiv online donation forms

Setting up matching gifts on Qgiv donation forms is simple. All you have to do is choose the form (or forms) on which you’d like to enable matching gifts, head to the form settings, and toggle on the matching gifts feature! You can add matching gifts to your Qgiv donation forms, event forms, and even peer-to-peer fundraising forms.

Matching gifts aren’t processed through the Qgiv system. They’re completed by the organization or employer. Thus, they’re classified as offline gifts. However, when a matching gift is submitted, the relevant data is available in your fundraising CRM.

These gifts will be facilitated by the settings you input (like whether or not unverified offline donations show up in your fundraising thermometer). To read more about enabling matching donations and configuring your offline donation settings, log in to your Qgiv account and check out this article.

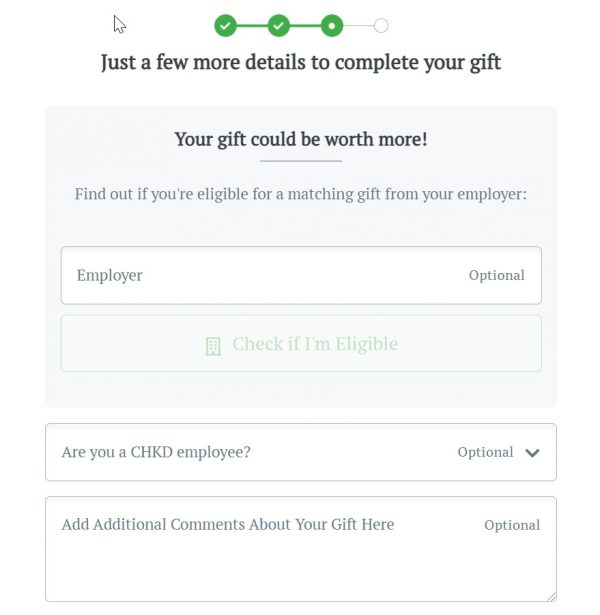

To offer matching gift searchability within your Qgiv online donation form, you can simply toggle on the matching gifts tools. From there, you can switch from Cyber Grants to Double the Donation or HEPdata. This way, your donors can quickly look up if they’re eligible themselves, as well as get all the necessary information on how to submit a matching gift form, when the deadline is, and more.

Children’s Hospital of The King’s Daughters uses the HEPdata integration with their Qgiv forms to encourage matching gifts for their Lighting the Way for Mental Health Campaign.

Additional Resources

If you’re not sure whether matching gifts are a worthwhile investment or you’re still curious about the best matching gift database company to partner with, here are some additional resources to supplement your research:

- Matching Gifts Best Practices. Review some of our top matching gift best practices, from how to promote them to the rules you need to know, in this article.

- How Automation Can Step Up Your Matching Gifts Program. Electronic matching gift forms and automation can take your matching gift fundraising to the next level. Find out how in this article.

- Learn to Market Your Matching Gifts Program. One of the obstacles to increasing matching gift revenue is that donors simply don’t know they qualify. Explore these top tips to market your own matching gift program effectively.