Writing an effective nonprofit donation receipt is important, but it doesn’t have to be stressful!

Your receipts should be practical, including all necessary information about your organization and the donor’s contribution. But a well-crafted donation receipt has lots of other benefits. It’s an opportunity to thank donors for their contributions immediately, while reminding them about your mission and why their help is so valuable.

A good receipt is tailored to your constituents and can encourage one-time donors to become ongoing supporters. In this post, I’ll share some tips and best practices to help you get the most out of your receipts.

Why do donation receipts matter?

Nonprofit donation receipts aren’t like the gas station or grocery store receipts that fill up your purse or wallet until you finally get around to throwing them away.

When a donor makes a contribution to your organization, they need proof of the gift for their tax records. And when transactions are processed online, receiving a receipt immediately provides confirmation that the payment was successful.

That’s why you need to make sure your nonprofit donation receipts are scheduled to send as soon as a gift is made.

Beyond those important pragmatic concerns, a customized donation receipt is your opportunity to personalize the paperwork and ensure that your donors know how grateful you are.

You want your donors to know that their gift is important to you, and a receipt is a great opportunity to emphasize that and to keep donors engaged with your mission.

So what goes into the nonprofit donation receipt?

First, make sure to include important details.

These details include your organization’s name, federal tax ID, and a note that you’re a 501(c)(3). You’ll also want to include the donor’s name, the donation amount, and the date of the gift.

If nothing else, these things will ensure that your receipt is useful as a tax document.

Create impact statements.

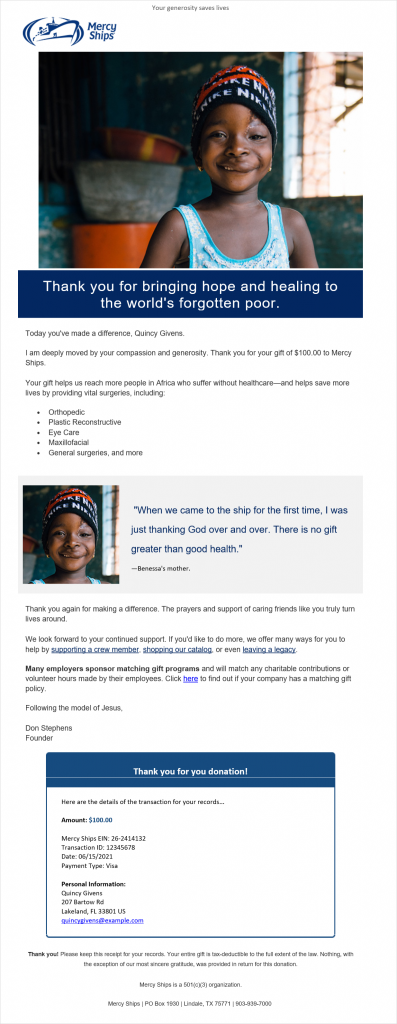

Donors want to know why their gift matters, so make it personal. Include stories and images that show the real-world impact of your organization and your donor’s gift, specifically.

Check out how Mercy Ships uses images and quotes to tell stories in their receipts:

Add conditional content.

Qgiv’s donation receipts can have conditional content blocks that will only populate when donors meet certain criteria.

For example, you can have a block that displays if a donor gives a little bit more to cover transaction fees. You probably want to thank them for that, so you can have an extra message that will only display for those donors.

Attach a locked PDF.

An email receipt is great, but if you can attach a locked PDF version of the receipt, that’s really helpful for donors. You can also add a PDF-specific note like, “Please keep this document for your tax records.”

For more on how to build your best receipt, check out Abby’s Anatomy of a Great Donation Receipt article!

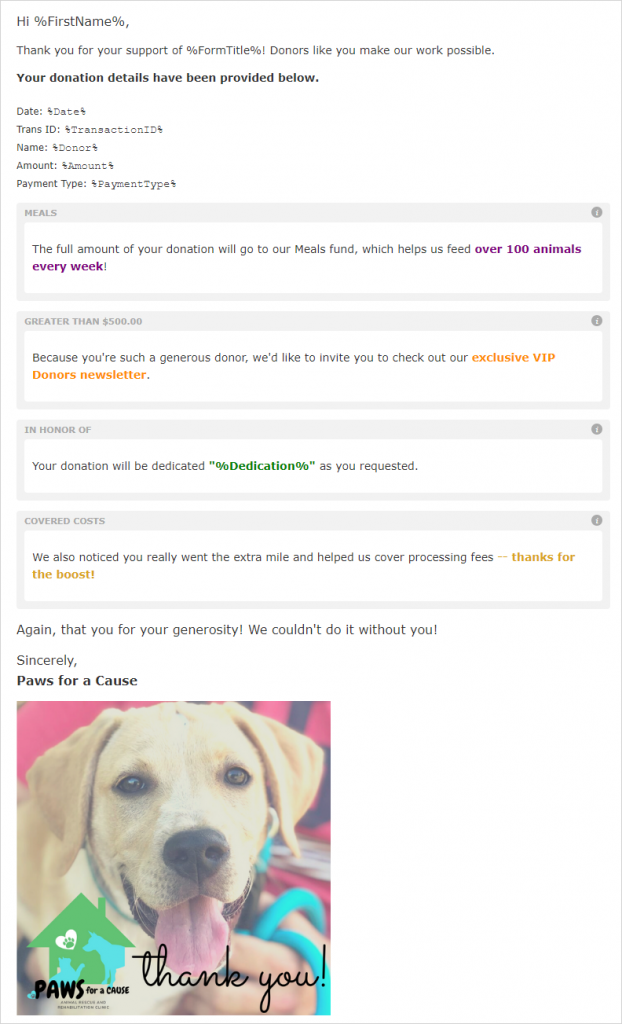

How to Use Conditional Content

Qgiv’s conditional content blocks for donation receipts make customizing and personalizing your receipts really easy. We have four conditional content types, and you can add as many blocks as you want. Each one is triggered by a donor’s actions.

For example, if your donation form includes restrictions, you can have a special message that displays if a donor gives toward a specific restriction.

We also have blocks for donation amounts, dedications, and GiftAssist.

This is what it looks like when you add a conditional content block while editing your receipt:

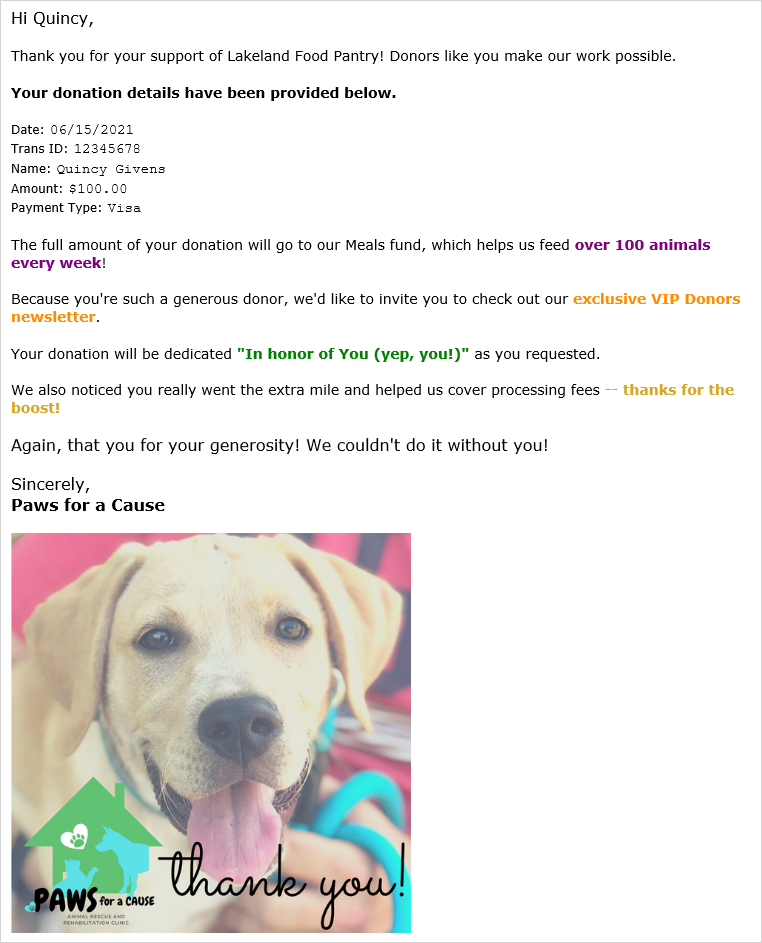

And here’s what it looks like when a donor receives a receipt with conditional content enabled:

These additional messages demonstrate that you recognize the donor’s specific contribution, which in turn, makes your receipts more personal.

Because your mission is personal. It’s personal to you, your beneficiaries, and your donors. Keep it personal, and make sure your donors know that you see them as real people with a real interest in what you’re doing.

Final Thoughts

Don’t let your donation receipts end up in the proverbial trash! Spend some time customizing your receipt content to ensure it’s both practical and effective.

Remember, an effective nonprofit donation receipt should:

- Make donors feel appreciated.

- Remind donors of your mission, while focusing on the impact of their specific gift.

- Keep donors engaged.

- Be an actual receipt.

Also, remember that the receipt should not be the only “thank you” to your donors. Quick thank-you calls or mailed thank-you notes are still best practice and make a difference!

Ready to start writing your receipt? Take a deep breath, and just dive in. As long as you keep your mission and your donors in mind, you’ll be fine!

But wait! There’s more!

Need help writing those all-important impact statements? We’ve got a great webinar on Storytelling for Impact that can help!

Of course, before donors see your awesome receipts, they have to donate. Check out these best practices for your donation forms.

Ready to take a look at our redesigned forms? These interactive templates are full of stats and tips!