Donors want to give to your nonprofit quickly and easily—and they want to do so online. With an overwhelming 63% of donors preferring to give online with a credit or debit card, having the right payment solution streamlines the donation process and lets donors contribute in the way that’s most convenient for them.

This guide will answer your questions about nonprofit credit card processing tools and provide several options for you to choose from:

Nonprofit credit card processing FAQs

What is a payment processor?

A payment processor manages the logistics of accepting electronic payments. Nonprofit organizations partner with payment processing vendors to easily accept donations as digitized payments.

Why is having a payment processor important?

Payment processors give nonprofit organizations the flexibility to accept payments online. Instead of relying on checks and cash, nonprofits can easily process transactions via credit/debit cards and eChecks.

With the rise of digital wallets like Apple Pay and Google Pay—there are now over 3.4 billion digital wallet users worldwide—it is even more important than ever to be able to accept digitized payments. Certain payment processors are specifically designed to take payments from digital wallets, giving donors even more freedom to give how they want to.

What types of payments can nonprofit credit card processing tools typically accept?

While each platform’s payment methods will differ slightly, most cover the following types of transactions:

- Credit cards

- Debit cards

- Apple Pay

- Google Pay

- Microsoft Pay

- Samsung Pay

- ACH

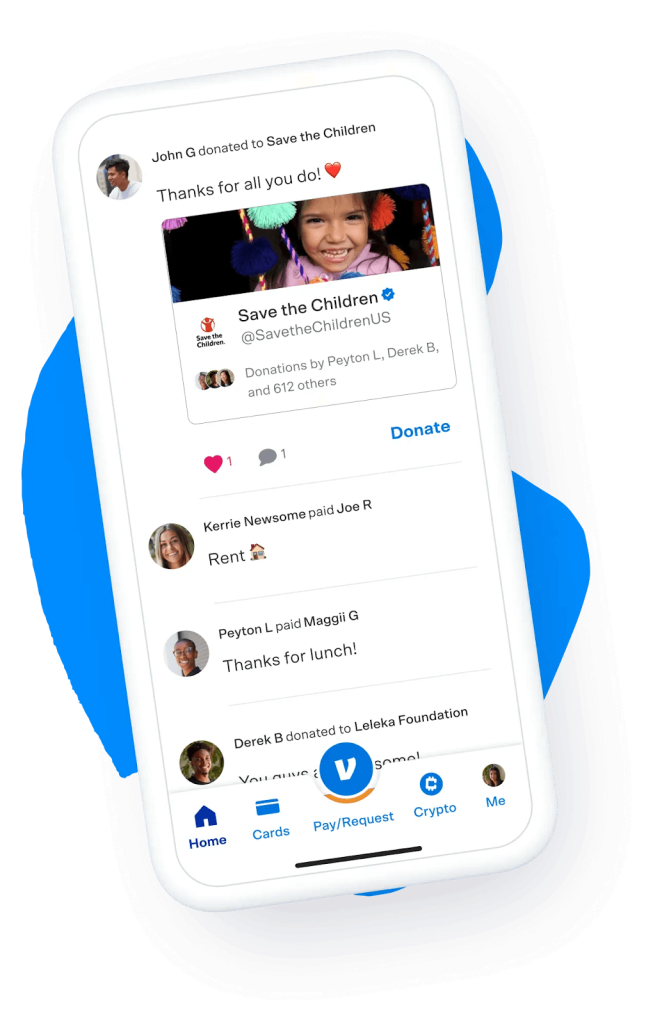

Additionally, many payment processors are increasingly accepting payments from apps like Venmo and Cash App and newer donation methods like donor-advised funds (DAFs) and cryptocurrency.

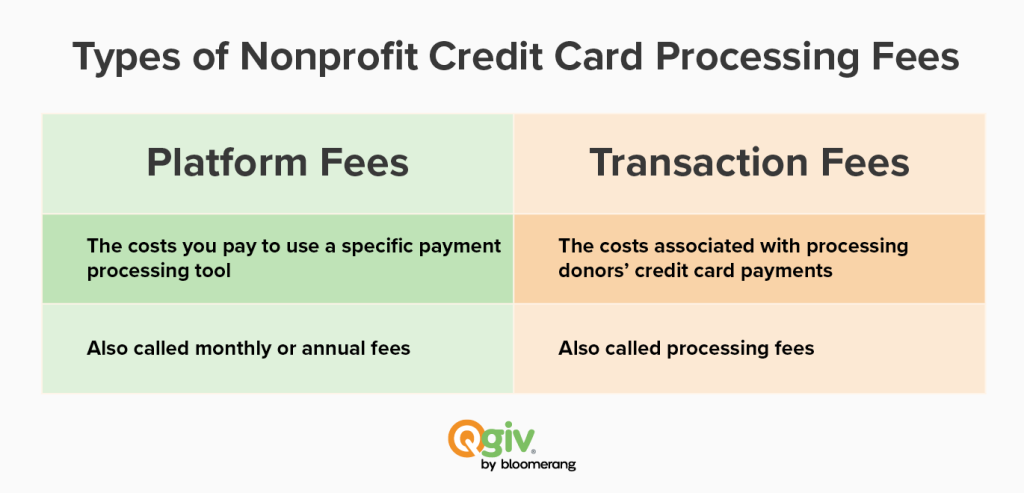

What are the different types of nonprofit credit card processing fees?

The two main types of nonprofit credit card processing fees are:

- Platform fees. Platform fees are the costs your nonprofit pays for using a specific payment processing tool. Vendors typically present platform fees as monthly or annual fees.

- Transaction fees. Transaction fees are the costs associated with processing donors’ credit card payments. Most platforms call this a processing fee.

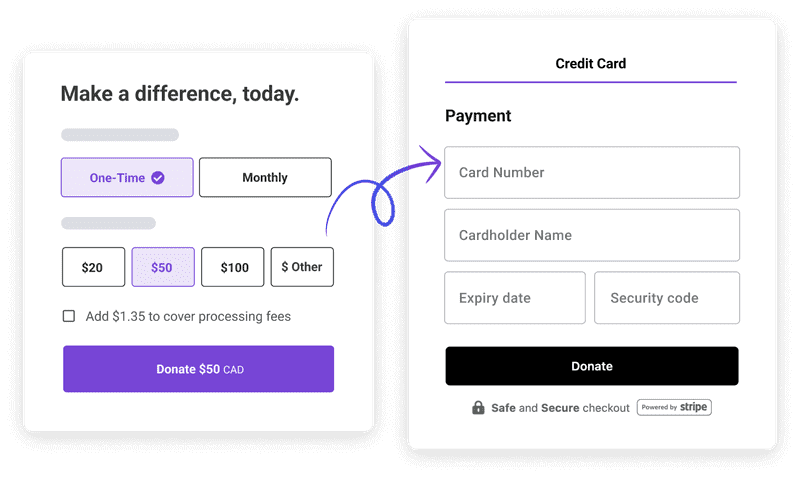

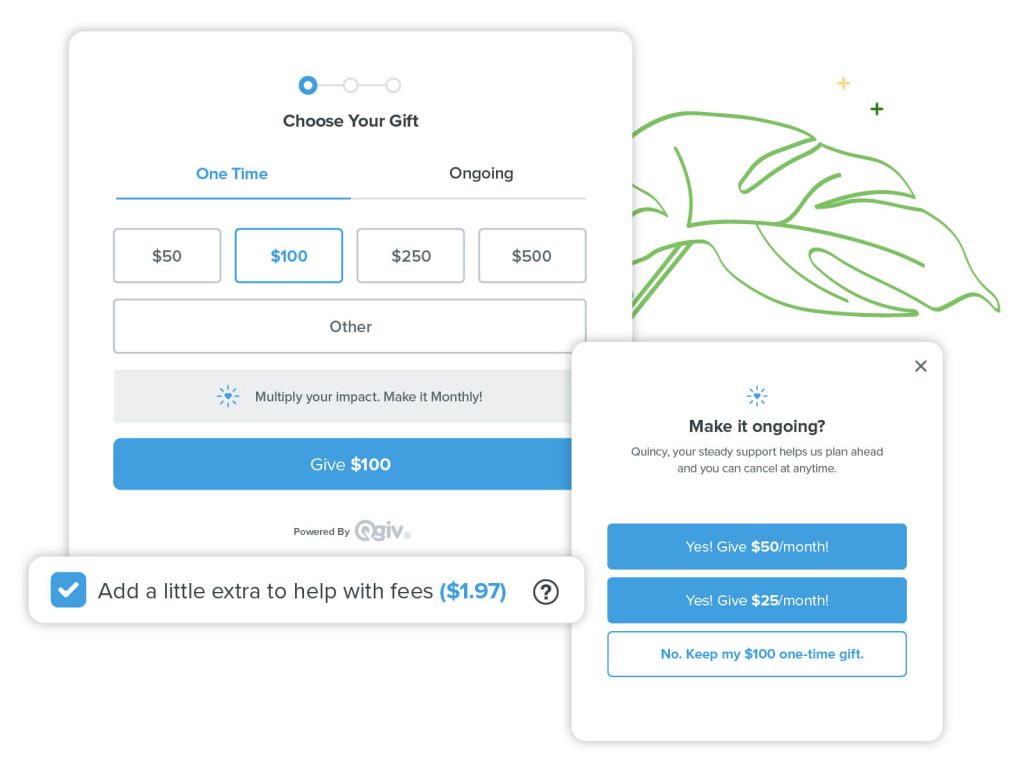

Many platforms allow you to ask donors to cover transaction fees. That way, you can maximize the funds going to your cause. Additionally, some platforms offer discounted payment processing fees specifically for nonprofits.

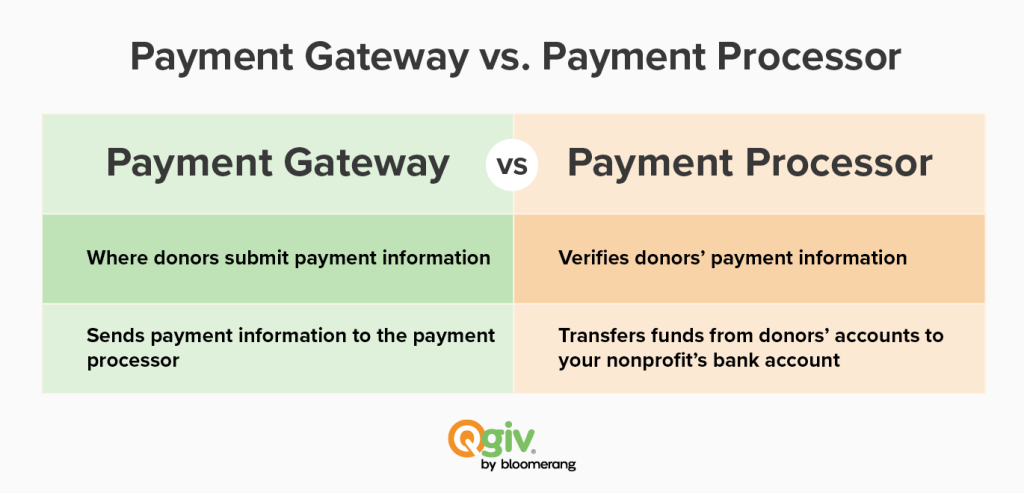

What is the difference between a payment gateway and a payment processor?

A payment gateway is where donors actually submit their payment information. In most cases, nonprofit payment gateways are donation pages found directly on each organization’s website. However, nonprofits may direct users to third-party platforms to collect payment information. Once a donor contributes, the payment gateway sends their payment information to the payment processor.

Then, the payment processor verifies the donors’ payment information, checking with their bank to ensure they have sufficient funds to contribute. If the payment processor approves the transaction, it will transfer funds from the donor’s account to your nonprofit’s bank account.

How can I select the right payment processor for my nonprofit?

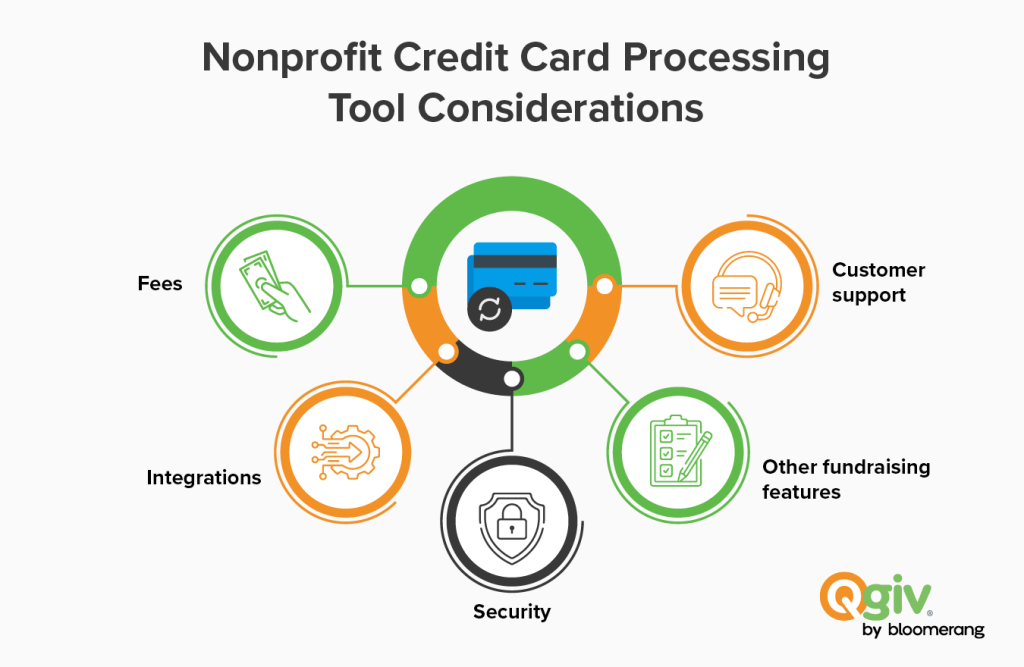

When choosing a nonprofit credit card processing platform, consider the following:

- Fees. While the option with the lowest fees won’t necessarily be the best platform, you still want to maximize the amount you can earn for your mission. Use each solution’s fee structure to calculate your net donation amount from each one. Remember that even if a solution has higher processing fees, offering the option to have donors cover them can offset costs.

- Integrations. Your payment processor should work seamlessly with your existing tools, including your nonprofit CRM, fundraising software, and accounting software. That way, you can more easily track donor information, follow up with supporters, and record transactions properly.

- Security. Donors trust that you’ll handle their sensitive payment information with care. Choose a platform with robust security measures that follow industry standards like PCI-DSS. These guidelines ensure you protect donor data, regularly test and monitor your network, implement access controls, and more.

- Other fundraising features. Beyond processing regular donations, your payment processor should also be able to accept recurring contributions. Many platforms allow donors to opt into recurring donations with a single click. Additionally, look for a solution that supports in-person payments, allowing you to easily process donations during fundraising events.

- Customer support. If your payment processor goes down, you’ll want to get it back up and running quickly so you can continue accepting donations for your cause. Assess each platform’s level of customer support and whether you can rely on them to respond quickly to inquiries.

Ask other similar organizations for their nonprofit credit card processing recommendations, and read online reviews to evaluate different solutions. Consult with your team to make the final decision on which platform is the best for your organization.

Top 10 nonprofit credit card processing tools

| Payment Processor | Best For | Top Feature | Payout Time | Fees |

| Qgiv | Cohesive online fundraising | GiftAssist, which enables donor-paid fees | Daily deposits with a one to two-day delay | 3.95% + $0.30 |

| Bloomerang Payments | Donor data collection | Integration with Bloomerang CRM | Daily deposits with a one to two-day delay | 2.2% + $0.30 |

| DonorPerfect | Over-the-phone donation processing | Insta-Charge | Two to three business days | Not directly stated on their website |

| PayPal | Small or new nonprofits | Customizable donation buttons | Two to three business days | 1.99% + fixed fee ($0.49 in the U.S.) |

| Stripe | Global audiences | Payment methods supported in over 195 countries | Two business days in the U.S. | 2.9% + $0.30 with discounted rates for nonprofits |

| Square | Point-of-sale transactions | Automatic donor segmentation | One to two business days or instantly for an additional fee | 2.9% + $0.30 for online payments and 2.6% + $0.15 for in-person payments |

| Authorize.net | Advanced security | Advanced Fraud Detection Suite | Two to three business days | 2.9% + $0.30 |

| Clover | Connection issues | Offline payment processing | One to three business days or instantly with an additional fee | 2.3% + $0.10 |

| Keela Pay | Customer support | Unlimited online training and email support | Nightly, weekly, or monthly | 2.2% + $0.30 for Visa, Mastercard, and Discover transactions |

| Venmo | Donor ease of use | Shareable in-feed donation posts | One to three business days or instantly for an additional fee | 1.9% + $0.10 |

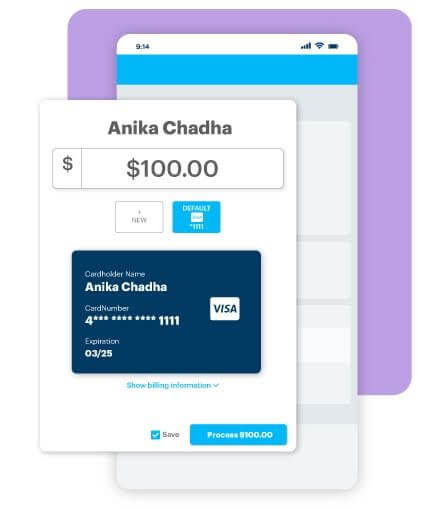

Qgiv: Best for cohesive online fundraising

Best for: Nonprofits looking for a solution that works seamlessly with other fundraising tools

Top feature: Qgiv’s GiftAssist feature allows donors to cover processing costs. You can set a percentage or fixed donation amount to be added to donation totals when donors choose to use Gift Assist, add thank-you content that appears in GiftAssist donors’ receipts, and maximize funds toward your mission. Additionally, Qgiv’s nonprofit credit card processing solution works seamlessly with its other fundraising tools, including event registration, text fundraising, peer-to-peer fundraising, and auction fundraising, for seamless donor experiences and data transfers.

Accepts payments from: Credit, debit, Apple Pay, PayPal, Venmo

Payout time: Daily deposits with a one to two-day delay

In-person transactions: Qgiv supports in-person transactions via card swipers that are available for purchase. These card swipers are compatible with Givi, Mobile VT, and Kiosk, or your team can manually enter payment information.

Fees: 3.95% + $0.30

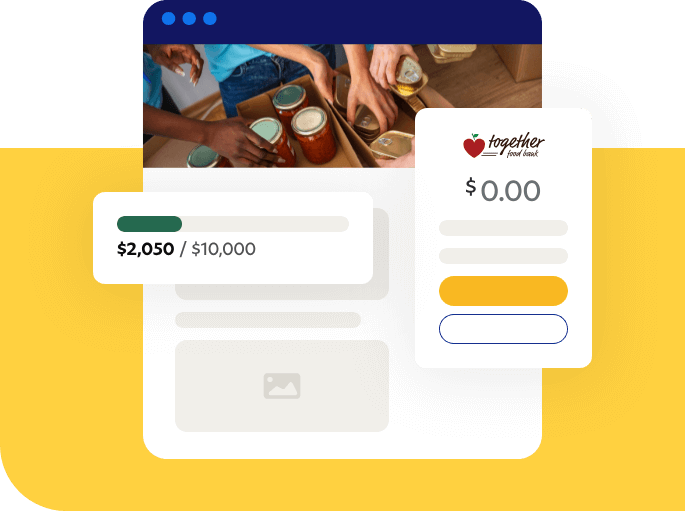

Bloomerang Payments: Best for donor data collection

Best for: Nonprofits looking for a platform that integrates with their Bloomerang CRM

Top feature: Data from Bloomerang Payments automatically flows into your Bloomerang CRM. That way, you can easily collect donor information and use it to form personal, long-lasting connections with your supporters. Bloomerang Payments also automatically updates outdated card information to better power recurring donations.

Accepts payments from: Credit, debit, ACH, Apple Pay, Google Pay, Microsoft Pay, PayPal, Venmo, Tap to Pay

Payout time: Daily deposits with a two-day delay

In-person transactions: Bloomerang offers Tap to Pay to easily collect in-person donations. Donors can tap their credit card or digital wallet on the mobile device your staff is using to collect donations.

Fees: Transaction fees of 2.2% + $0.30 for credit and debit card payments and 0.8% + $0.30 for ACH transactions

DonorPerfect: Best for accepting donations over the phone

Best for: Nonprofits looking to accept donations from anywhere, including over the phone

Top feature: DonorPerfect’s Insta-Charge feature allows you to process phone donations directly from a donor’s record.

Accepts payments from: Credit, debit, ACH, PayPal, Venmo

Payout time: Two to three business days

In-person transactions: DonorPerfect users can collect in-person donations using the mobile app.

Fees: Not directly stated on their website

PayPal: Best for small or new nonprofits

Best for: Nonprofits that are just starting to accept online donations

Top feature: PayPal allows users to customize their own donation buttons and add them directly to their websites. Then, nonprofits can select which donation amount options to offer donors and can even designate specific programs for donors to choose from.

Accepts payments from: Credit, Debit, PayPal, Venmo, Pay Later, digital wallets

Payout time: Two to three business days

In-person transactions: PayPal enables in-person transactions through QR codes and card readers.

Fees: 1.99% + fixed fee ($0.49 in the U.S.)

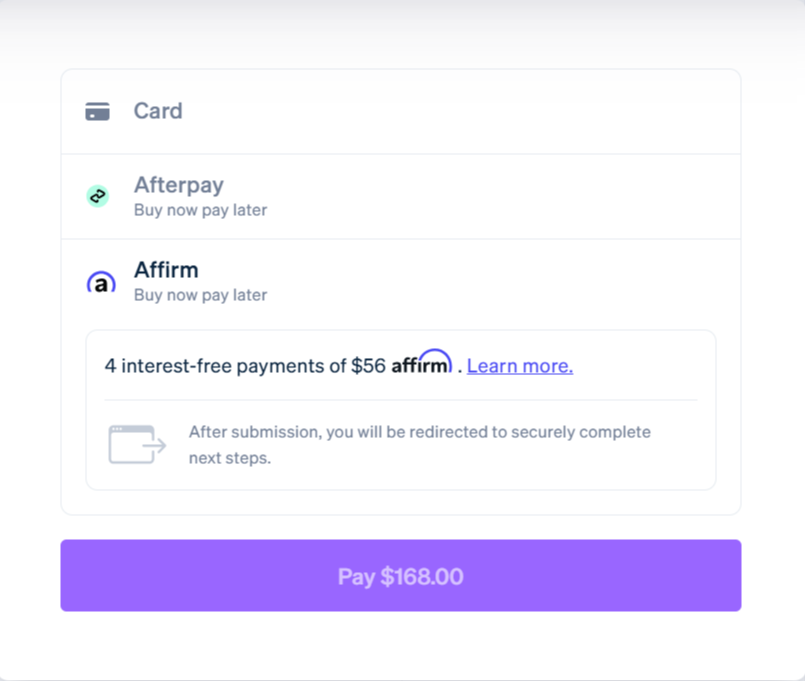

Stripe: Best for nonprofits with global audiences

Best for: Nonprofits with a global audience

Top feature: Stripe has a global reach with various payment methods supported in over 195 countries.

Accepts payments from: Credit, debit, ACH, Apple Pay, Google Pay, Cash App Pay, Samsung Pay, Amazon Pay, PayPal, Afterpay, Klarna, Alipay, and more

Payout time: Two business days in the U.S.

In-person transactions: Stripe accepts in-person payment via the Stripe Terminal, their card reader.

Fees: 2.9% + $0.30 with discounted rates for nonprofits

Square: Best for point-of-sale transactions

Best for: Nonprofits managing point-of-sale transactions

Top features: Square automatically adds donors to a directory and segments them into groups, such as loyal, casual, and lapsed supporters.

Accepts payments from: Credit, debit, ACH, Apple Pay, Google Pay, Samsung Pay, Cash App Pay, Afterpay

Payout time: One to two business days or instantly for an additional fee

In-person transactions: Square supports in-person transactions via Square Register, Square Terminal, Square Kiosk, Square Stand, Square Reader, or Tap to Pay on the Square Point of Sale app.

Fees: 2.9% + $0.30 for online payments and 2.6% + $0.15 for in-person payments

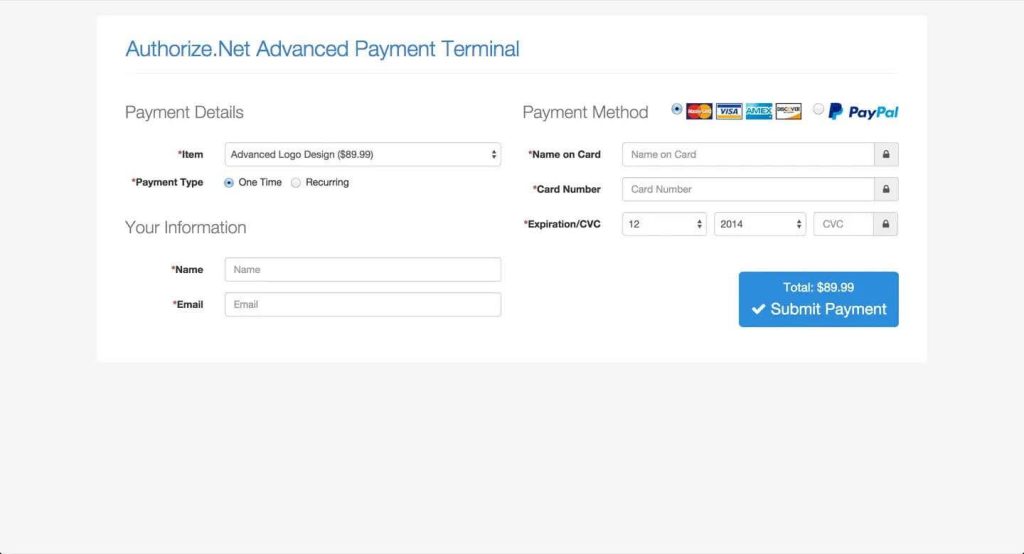

Authorize.net: Best for advanced security

Best for: Nonprofits looking for advanced security features

Top feature: Authorize.net offers an Advanced Fraud Detection Suite (AFDS) to protect your nonprofit from fraudulent transactions.

Accepts payments from: Credit, debit, PayPal, eCheck, Apple Pay

Payout time: Two to three business days

In-person transactions: Authorize.net enables in-person transactions via their mobile app or card reader.

Fees: 2.9% + $0.30

Clover: Best for connection issues

Best for: Nonprofits that may experience technical difficulties or connection issues

Top features: Clover can take payments with or without WiFi and process offline transactions as soon as you reconnect.

Accepts payments from: Credit, debit, cash, checks, Apple Pay, Google Pay, Samsung Pay

Payout time: One to three business days or instantly with an additional fee

In-person transactions: Clover supports in-person transactions via their Virtual Terminal, mobile app, or card readers.

Fees: 2.3% + $0.10

Keela Pay: Best for customer support

Best for: Nonprofits looking for robust customer support

Top features: Keela offers unlimited online training and email support with every plan.

Accepts payments from: Credit, debit, ACH, Stripe, PayPal

Payout time: Nightly, weekly, or monthly

In-person transactions: Not supported

Fees: 2.2% + $0.30 for Visa, Mastercard, and Discover transactions

Venmo: Best for donor ease of use

Best for: Nonprofits looking for a solution most donors already know how to use

Top feature: Venmo allows donors to share their donations on their feeds to encourage their friends and family to show their support.

Accepts payments from: Credit, debit, PayPal, linked bank accounts, Venmo balance

Payout time: One to three business days or instantly for an additional fee

In-person transactions: Venmo supports in-person transactions via QR codes and Tap to Pay.

Fees: 1.9% + $0.10

Final thoughts

Using a nonprofit credit card processing tool allows you to easily and reliably accept donations. If you haven’t decided on a payment processor for your nonprofit yet, use this list as a guide, weigh the pros and cons of each option, and decide which one is best suited for your organization.

Want more support with the fundraising process? Check out these additional resources:

- How to Create a Donation Page that Catapults Fundraising. Your payment processor is just one element of your overarching donation page. Learn how to create a robust page that takes your fundraising to the next level.

- How to Write a Meaningful Donor Thank-You Letter. Once you’ve processed donors’ contributions, show your appreciation for their generosity. Explore this guide to ensure your thank-you letters are meaningful.

- 30 Most Effective Nonprofit Software Solutions for 2025. Optimize your operations across the board with powerful nonprofit software. Check out our top recommendations.